Over the past few years there has been much discussion at both the federal and provincial levels in respect of…

DEMAND FOR CLIENT INFORMATION: CRA’s Abilities

CRA uses third parties to get information about other taxpayers to ensure they are complying with their tax responsibilities. This…

WORKERS COMPENSATION: Replacement Payouts by Employer

In a March 29, 2019 Tax Court of Canada case, the taxpayer had been injured on the job and was…

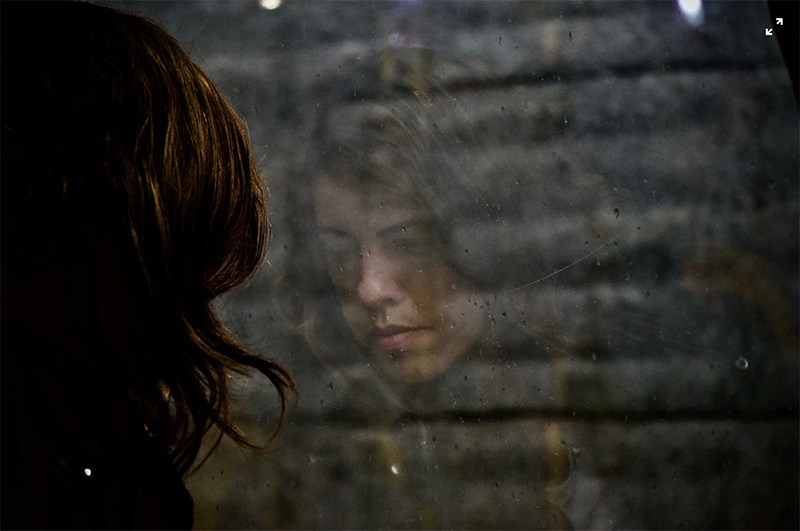

ANXIETY, DEPRESSION & PHOBIAS: Disability Tax Credit

In an April 3, 2019 Tax Court of Canada case, at issue was whether the impact of an individual’s mental…

ZERO-EMISSION VEHICLES: Personal and Corporate Incentives

On April 17, 2019, Transport Canada released details on the purchase incentive of up to $5,000 for zero-emission vehicles as…

REIMBURSEMENT FOR WORK CLOTHING: Taxable

In an April 17, 2019 Technical Interpretation, CRA was asked whether clothing reimbursements paid to maintenance employees were taxable benefits….