In a January 29, 2019 Technical Interpretation, CRA discussed the criteria for tax-exempt allowances for board and lodging received for…

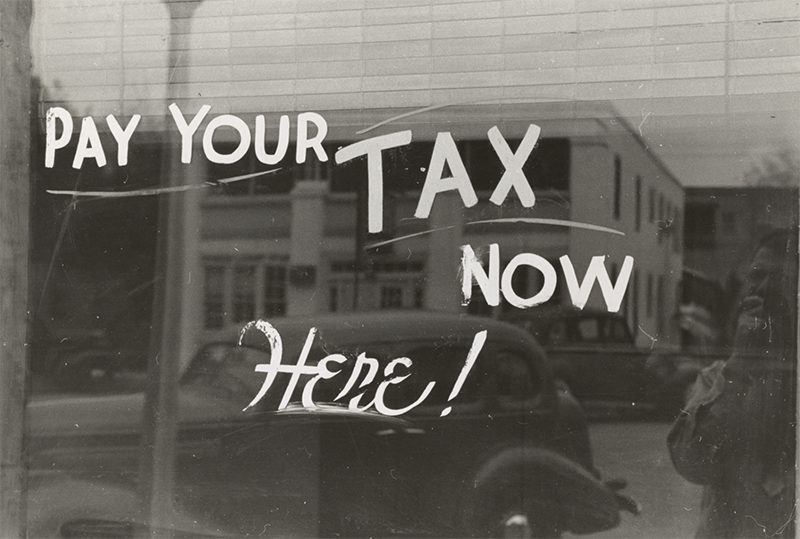

Tax Ticklers: Some Points To Consider

CRA’s limited review of corporate tax return projects have a reassessment rate of approximately 40%. In the past few years,…

SHARED CUSTODY OF A CHILD: The “Equal or Near Equal” Issue

Certain tax benefits, such as the Canada child benefit, the GST/HST rebate, and the recently implemented federal carbon tax incentive…

GST/HST NEW HOUSING REBATE: Meeting the Conditions

In a December 18, 2018 Tax Court of Canada case, the Court considered whether the new housing rebate was available…

VIDEO LEGACY: What Message Am I Leaving?

When conducting our estate plans, we are often focused on the distribution of assets (such as homes, bank accounts, investments,…

SAUNA AND HYDROTHERAPY POOL: Medical Expense Tax Credit

In a December 4, 2018 Technical Interpretation, CRA was asked whether the costs of installing a steam shower (sauna) and…